The most frequent question we are asked is, “How do you guys afford to travel?” First, I would say we are very blessed, but mostly it’s because we prioritize travel over pretty much everything else. Sure, there are countless ways that we have found to travel cheap (and still pretty comfortably), and we will share those tips with you too, but we’ll start off slow 😉

Set a Budget

If you don’t set a budget, what’s stopping you from spending everything you make? Figure out what is essential for you to live and create spending limits. Sure, you have to pay rent and gas and electricity, etc., but you don’t have to spend $100 a month in clothes or $70 a month on cable. Between eating out, buying green juice, monthly subscriptions, and Apple Pay, it’s all too easy to spend money without even realizing it. We use Mint to establish our overall budget and track how much we spend each month in each specific area, so we can keep track of where all of our money goes. It allows us to keep an eye on all of our accounts (checkings, savings, credit cards) in one location. Remember, you have to set your total budget to much less than you make for this to have a positive effect. We challenge you to set it as low as you can, so you can pay yourself back with what you didn’t spend.

Pay Yourself First

You’ve probably heard it before, but as soon as you receive your paycheck, pay yourself. Yes, it is absolutely possible to have an income but never get paid. Too many people live paycheck-to-paycheck, because they spend their money on perceived necessities and never end up actually keeping any of the money they’ve worked hard for! Whether it’s 10% or 40% or 1%, make sure you take some of that money you earn and put it away as soon as you receive your paycheck. We have two savings accounts: one for general savings (you know, like for a house one day) and one for travel. You can decide how much you put in each, but if you’re putting even a few dollars in each savings account every few weeks, it’ll add up faster than you think. To make sure you don’t cheat yourself out of getting paid, create automatic transfers that occur as soon as you get your paycheck and set your budget to the amount of remaining income.

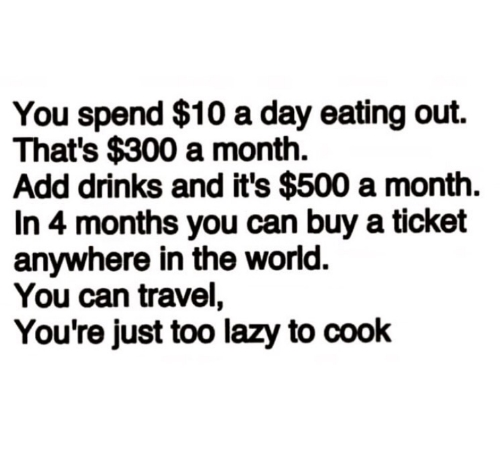

Only Eat Out Once a Week and Cut Out Other Expenses

We made a goal to eat out once a week. Everyone deserves a date night (and a night where you don’t have to cook, because honestly…🙄)! So don’t totally torture yourself, but when we saw this meme, we realized it is honestly so true! Eating out adds up. And when you add the kale smoothies and gluten-free donuts to your meal, Saturday morning brunch adds up faaaast. 🙈 Also, look for other items things that are secretly stealing money from your bank account, and then cancel those snack box and magazine subscriptions and find someone to split your Netflix account with (don’t worry… we would never suggest canceling it). Take that money that you were spending on these and put it straight into your travel savings account.

Put All Your “Extra Money” In Travel Savings

You know the $50 your grandma gives you for your birthday or that surprise bonus you get or even the $10 you were under budget last month? Take that money and put it directly in your travel savings account. Believe me, we know how tempting it is to go buy a new pair of shoes or splurge on a fancy dinner. But let’s be honest, in the long run you’ll want another pair of shoes in a month anyway, but a trip to Bali, now that’s an experience you’ll never forget.

Get A Travel Credit Card

Normally the first year fee is waived and if you spend a certain amount of money in the first one-three months, you get a significant bonus in points. Hello, free travel money! We treat our credit card as if it were our debit card. Obviously this takes a lot of discipline, especially because sometimes credit cards seem like free money (but that interest fee definitely is not), so don’t do it unless you are absolutely positive you can exercise self-control and pay it off at least biweekly. Say we have $1,000 in our checking account. We treat our credit card as if the limit is $1,000 (even if it’s $20,000). Then, we get points for every purchase we make, and we pay off our credit card every few weeks (or days haha). That way, you earn money in points for every purchase you make!

Check out this website to decide which card is right for your travel needs.

So next time you get that $20 of birthday cash from your grandma, don’t run to Starbucks. Instead, put that money directly in your travel savings account, and you’ll be headed to Bali before you know it! And if you still can’t resist the urge for the Venti Double Chocolate Chip Frappuccino, then please at least use your travel credit card to earn some free points! And don’t forget to pay it off…

If you’re planning your trip now, please use these links to look for cheap flights, great hotel deals, and other things to do. By using these links you will help us keep the lights on at no extra cost to you!

I love this. I get this question often as well. It’s amazing what people could do with their eating out money if they just saved it.

Yes, totally! It’s all about priorities! If they want to make travel a priority, then they’ll find a way to make it work!

I just cancelled subscriptions I could live without thanks to this post! x

That’s awesome! Glad you could take advantage of one of our tips. Keep it up and let us know if you ever have any questions.